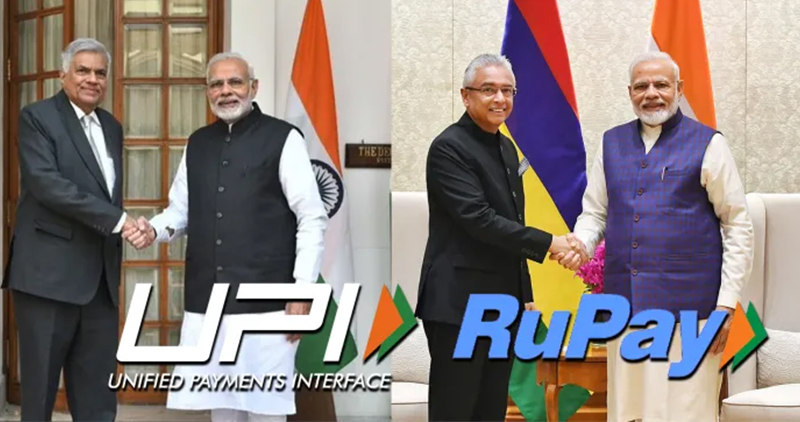

Scope of UPI, RuPay card will increase, will be launched in Sri Lanka and Mauritius

The use of Unified Payment Interface (UPI) service has increased rapidly in the country in the last few years. It is expanding abroad also. In this series, UPI service will be launched in Sri Lanka and Mauritius on Monday. Along with this, RuPay card service will also be introduced in Mauritius. On the occasion of the launch of these services, Prime Minister Narendra Modi, Sri Lankan President Ranil Wickremesinghe and Mauritius Prime Minister Praveen Jugnauth will be present through video conferencing.

Reserve Bank of India (RBI) said in a post on social media platform Will be able to issue RuPay based cards and RuPay cards can be used for payments in India and Mauritius. The External Affairs Ministry said that India has emerged as a leading country in fintech innovation and digital public infrastructure. Prime Minister Narendra Modi’s emphasis is on sharing the country’s development experience and innovation with allied countries.

The scope of digital rupee is also increasing. This has made it easier for the Reserve Bank of India (RBI) to meet its target of 10 lakh transactions per day by the end of last year. Central Bank Digital Currency (CBDC) or e-Rupee has been created through distributed ledger technology as a digital alternative to cash. The trial of e-rupee was started by RBI. However, after this, by October last year, these transactions had reached about 25,000 per day. Its use case was also expanded and it was linked to the widely used Unified Payment Interface (UPI).

UPI provides the facility to send money through mobile apps. At the end of last year, some big government and private banks had transferred the amount related to employee benefit schemes to the CBDC wallets of employees. These included HDFC Bank, Kotak Mahindra Bank, Axis Bank, Canara Bank and IDFC First Bank. Due to this, these transactions have increased rapidly. RBI expects that some non-financial firms may also use this method. With this, these transactions can be further increased.